Experts in Little Rock accounting explain long-term tax benefits

Experts in Little Rock accounting explain long-term tax benefits

Blog Article

Why Finding Specialist Tax Services Is Essential for Your Financial Assurance

Maneuvering the intricacies of tax regulations can really feel frustrating, particularly with continuous modifications that can affect your funds. That's where expert tax obligation solutions can be found in. By picking experts that recognize these intricacies, you're not just making sure conformity; you're likewise setting the stage for much better financial end results. The actual inquiry is: exactly how do these services particularly address your special scenario and aid you stay clear of mistakes?

Comprehending the Intricacy of Tax Regulations

Comprehending the intricacy of tax regulations can feel frustrating, especially if you're managing them for the initial time. You've most likely experienced a labyrinth of regulations, types, and target dates. Tax codes alter frequently, making it difficult to remain current. Every year, brand-new deductions and credit reports arise, while others vanish, complicating your preparation.

You could find it testing to establish what gets deductions or exactly how to report earnings properly. Missing out on a vital detail might cause pricey mistakes. It is necessary to understand not just the guidelines but additionally just how they use especially to your unique situation.

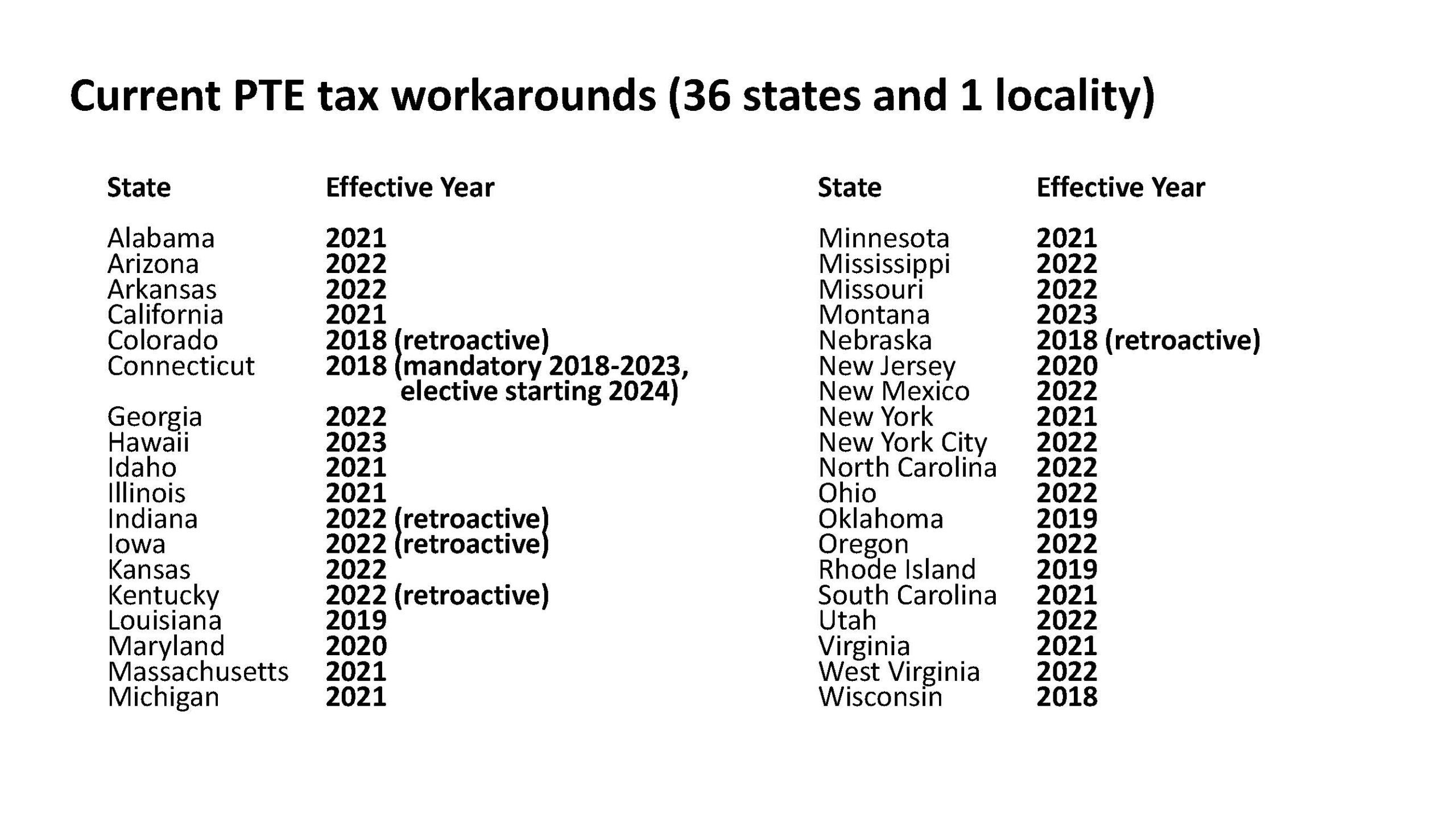

Additionally, state and government legislations can differ markedly, adding another layer of complexity. As you navigate through this intricate landscape, it's vital to prioritize precision and conformity to stay clear of fines. Spending time to recognize these legislations can settle, ensuring you're much better gotten ready for tax season and your economic future.

The Advantages of Specialist Experience

When you get the aid of expert tax services, you get to a wide range of understanding that can simplify your tax experience. These specialists remain updated with the current tax regulations and guidelines, ensuring you're compliant and educated. Arkansas CPA firm. This suggests you can concentrate on what really matters-- your financial objectives-- without the tension of maneuvering intricate tax codes alone

Additionally, having an expert at hand can improve your self-confidence in managing tax-related issues. You'll really feel safe understanding that you're backed by someone who understands the complexities of the tax landscape, ultimately providing you with peace of mind throughout the procedure.

Staying Clear Of Pricey Blunders

Despite skilled support, tax obligation period can still offer pitfalls that lead to costly mistakes. You may ignore essential target dates, misinterpret tax laws, or fail to offer complete documentation. These errors can result in fines, missed out on refunds, or perhaps audits.

When you select expert tax obligation solutions, you're not just getting help; you're also acquiring a safety and security net that assists you navigate these potential traps. Professionals remain upgraded on the current tax obligation codes and guidelines, guaranteeing that your filings abide by all demands - Frost PLLC. They can identify discrepancies that you might miss out on and assist you with complicated scenarios

In addition, experienced tax advisors can assist you double-check your details, lowering the chances of blunders. By purchasing specialist services, you can concentrate on your economic goals as opposed to stressing over the effects of errors. Secure your peace of mind and let the specialists deal with the ins and outs of tax preparation.

Making The Most Of Reductions and Credit Histories

To optimize your tax obligation savings, you require to recognize the various deductions offered to you. Recognizing qualified credit scores can better boost your refund, however calculated tax obligation preparation is necessary to ensure you don't miss out on out on possibilities. Allow's explore how to take advantage of your tax scenario effectively.

Understanding Tax Deductions

Recognizing tax reductions can substantially affect your monetary circumstance, especially when you recognize exactly how to optimize them. By tactically preparing your deductions, you can substantially lower your tax liability and preserve even more of your hard-earned money. Consulting with tax obligation specialists can aid you navigate these chances successfully.

Determining Qualified Credit Histories

How can you assure you're not leaving cash on the table when it involves tax credits? The secret is recognizing all eligible debts offered to you. Beginning by reviewing your monetary scenario and any modifications that might qualify you for credit reports, like education and learning expenses or energy-efficient home enhancements. You could also be eligible for credit scores related to dependent care or adoption.

Consulting a skilled tax obligation solution can aid you browse these possibilities. They'll ascertain you know both federal and state credit scores that apply to your circumstance. By making the effort to determine and declare these credit reports, you'll optimize your tax obligation cost savings and improve your monetary comfort. Don't let neglected credit histories reduce your possible reimbursement!

Strategic Tax Obligation Preparation

By taking a proactive technique, you can recognize opportunities to maximize your reductions and credit scores throughout the year, instead than simply during tax season. Functioning with an experienced tax service, you can create a tailored method that straightens with your financial goals. Ultimately, efficient tax planning not just improves your financial savings yet also provides peace of mind, knowing you're making the most of your financial circumstance.

Time-Saving Advantages

When you select skilled tax obligation solutions, you considerably lowered the moment invested going across intricate tax codes and paperwork. Rather than pouring over forms and attempting to figure out policies, you can concentrate on what truly matters-- growing your business or appreciating your individual life. Tax obligation specialists simplify the procedure by effectively gathering required files, guaranteeing everything is in order, and declaring on your part.

You will not have to worry concerning missing out on due dates or making costly blunders that can cause audits or charges. Their know-how enables them to quickly recognize reductions and credits you could ignore, maximizing your advantages in less time. Plus, with their expertise of the most recent tax laws, they can adjust your technique as laws alter, saving you the problem of continuous updates. Ultimately, spending in expert solutions implies redeeming your important time for even more satisfying pursuits.

Anxiety Decrease and Assurance

By entrusting your tax needs to professionals, you can substantially lower the stress related to tax season. The intricacies of tax obligation legislations and laws can be frustrating, yet professionals navigate these challenges daily. They understand the nuances and ensure your returns are filed precisely and in a timely manner, relieving the fear of possible fines.

In addition, expert tax obligation solutions supply tailored focus, resolving your special monetary circumstance. You won't have to second-guess your reductions or credit ratings; the experts will certainly recognize every possibility to maximize your refund or minimize your responsibility.

With this support, you can concentrate on what truly matters-- your family, career, and personal passions-- as opposed to worrying over documents and due dates. When tax time rolls about, understanding you have an experienced team at hand brings peace of mind. You'll really feel certain that your monetary health and wellness remains in qualified hands, allowing you to breathe much easier throughout this often-stressful time.

Long-Term Financial Planning and Approach

When you think concerning lasting monetary preparation, a considerable monetary assessment is look at this website crucial to understanding your one-of-a-kind circumstance. You'll wish to check out tactical tax obligation minimization strategies that can help you maintain more of your hard-earned cash. Together, these steps will certainly set you on a course toward higher financial protection.

Comprehensive Financial Evaluation

An extensive monetary evaluation lays the groundwork for efficient long-lasting monetary planning and technique, assisting you determine your goals and the best paths to achieve them. By evaluating your current financial scenario, consisting of revenue, expenditures, properties, and obligations, you get useful understandings into where you stand.

Strategic Tax Minimization Strategies

Calculated tax minimization strategies are necessary for enhancing your economic wellness and accomplishing long-term objectives. By leveraging deductions, credit scores, and tax-efficient investments, you can considerably reduce your tax obligation concern. Take into consideration tax-loss collecting to balance out gains and seek advice from with a tax obligation professional to discover tax-efficient approaches tailored to your scenario.

Frequently Asked Concerns

How Do I Pick the Right Tax Obligation Service for My Requirements?

To choose the appropriate tax solution, examine your certain needs, contrast services offered, read customer reviews, and ask about expertise in your circumstance. Do not think twice to ask concerns; locating the right fit is important.

What Qualifications Should I Seek in a Tax Specialist?

When choosing a tax expert, search for qualifications like a certified public accountant or EA designation, relevant experience, and favorable customer evaluations. Ensure they're knowledgeable regarding your certain tax obligation circumstance to guarantee you get the most effective advice.

How Much Do Specialist Tax Obligation Solutions Generally Cost?

Specialist tax obligation services normally cost in between $150 and $500, depending on complexity and area. You'll intend to compare fees and services provided to guarantee you're getting the most effective value for your requirements.

Can Tax Services Assist With Audits or Disputes?

Yes, tax services can most definitely aid with audits or conflicts. They'll assist you with the process, represent you, and assure you comprehend your legal rights, making the experience less demanding and a lot more workable for you.

Are There Details Tax Obligation Services for Small Companies?

Yes, there specify tax services customized for local business. These solutions typically include accounting, tax preparation, and compliance aid, assisting you navigate complicated policies while taking full advantage of deductions to enhance your overall monetary health.

Report this page